Catawba County Property Tax Rate 2025. Tax rate fiscal year 2025 / 2025. Catawba countycommissioners adopt fiscal year 2025/24 county budget.

This includes the county, seven cities or towns and 16 fire districts. The new assessment values will take effect in january,.

In terms of property value increase, on average, catawba county property owners can expect to see increases in the range of 50% to 70%, he said.

Catawba County Historic Tax Maps, Tax rate effective from 1 jan 2025 to 31 dec 2025 property tax payable; This page contains tax rates as approved for lincoln county and city of lincolnton for fiscal year/budget year 2025/2025.

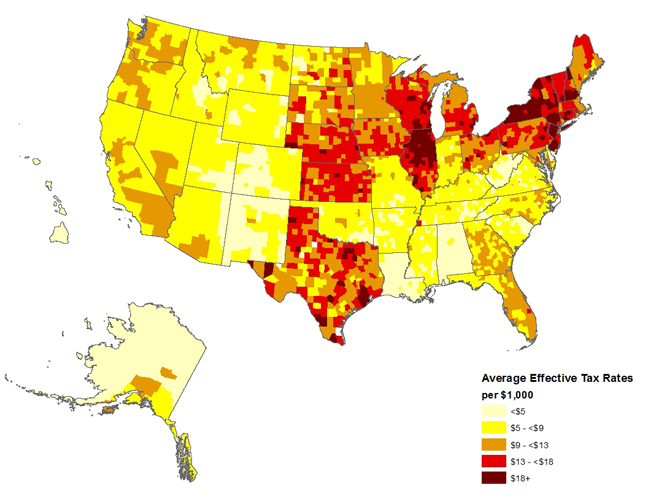

NAHB Now Property tax rates vary across and within counties OkHBA, Property tax values in catawba county are likely to increase in the coming revaluation, data collection for which is underway. Your property tax payment is due on 31 jan 2025.

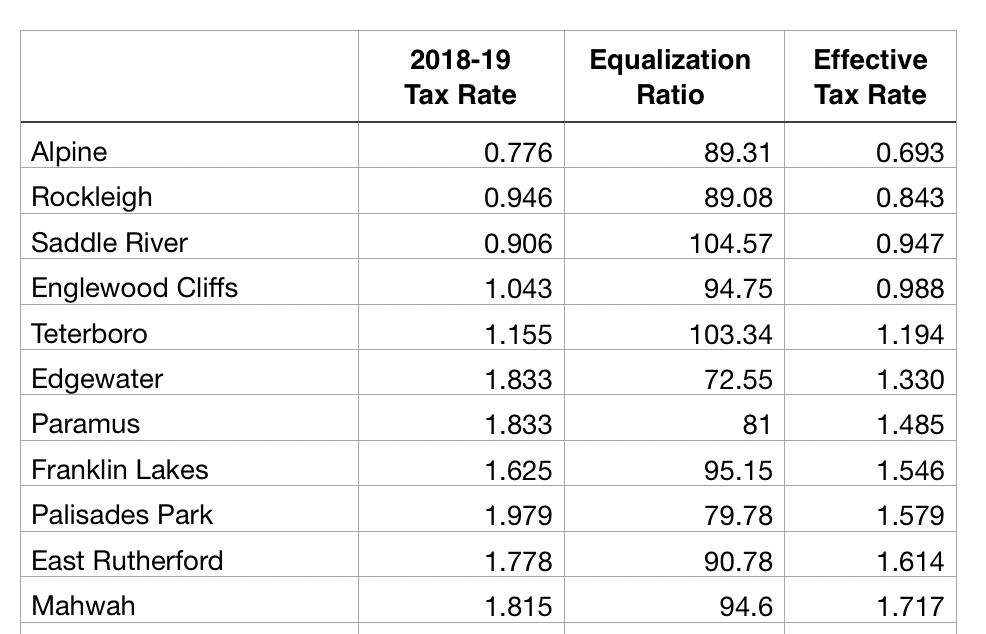

33+ how to calculate nj property tax LadyArisandi, Tax rates provided by avalara are updated regularly. Tax year 2025 tax calculation.

Catawba County manager proposes lower tax rate YouTube, On june 5, the catawba county board of. The new assessment values will take effect in january,.

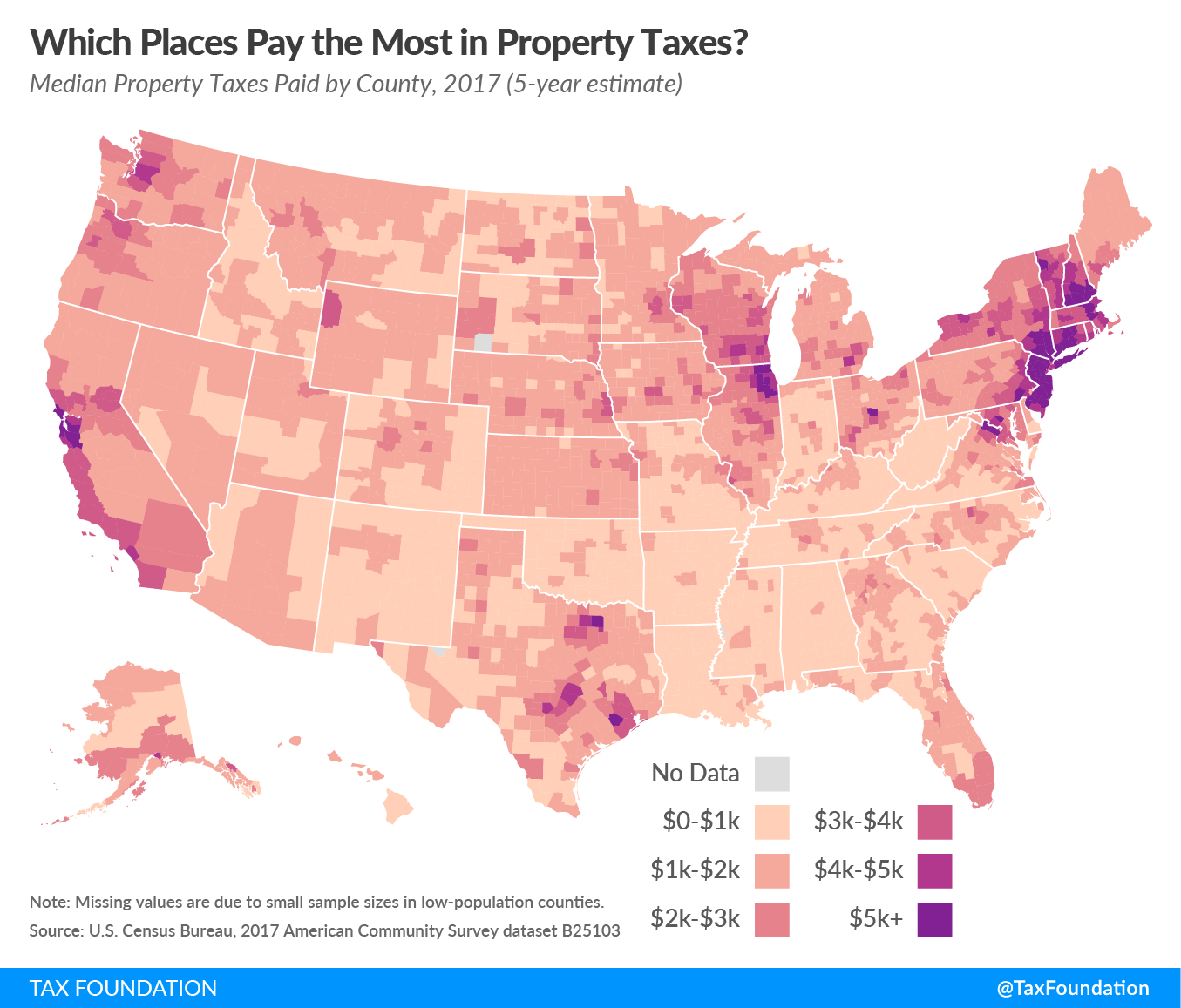

How High Are Property Taxes in Your State? Tax Foundation, These rates are per $100. Catawba county has a tax rate of $0.575 per $100 of assessed value.

Which Texas MegaCity Has Adopted the Highest Property Tax Rate?, Tax rate effective from 1 jan 2025 to 31 dec 2025 property tax payable; These rates are per $100.

Catawba County leaders propose property tax rates, In terms of property value increase, on average, catawba county property owners can expect to see increases in the range of 50% to 70%, he said. Tax rate effective from 1 jan 2025 to 31 dec 2025 property tax payable;

nassau county property tax rate 2025 Marin Rinaldi, Catawba countycommissioners adopt fiscal year 2025/24 county budget. Take a look at the tax.

Property Taxes by County Interactive Map Tax Foundation, Iras will send customised sms reminders with your property address, tax amount to be paid and. These rates are per $100.

Catawba County NC property tax values 2025. Don't Panic Yet YouTube, On june 5, the catawba county board of commissioners adopted a fiscal year 2025/2025 budget of $299,776,474 effective july 1, 2025. This includes the county, seven cities or towns and 16 fire districts.

This page contains tax rates as approved for lincoln county and city of lincolnton for fiscal year/budget year 2025/2025.